In Texas, to better understand the possible tax consequences of selling a house, it is necessary to have a grasp of capital gains tax. At the federal level, capital gains are the profits that an individual earns from disposing of their asset like a home. In order to relieve homeowners from this burden by not having state-level capital gains taxes imposed on them, Texas has been successful. However, it is still important to know about the federal capital gains tax provisions and how they relate to home sales in Texas.

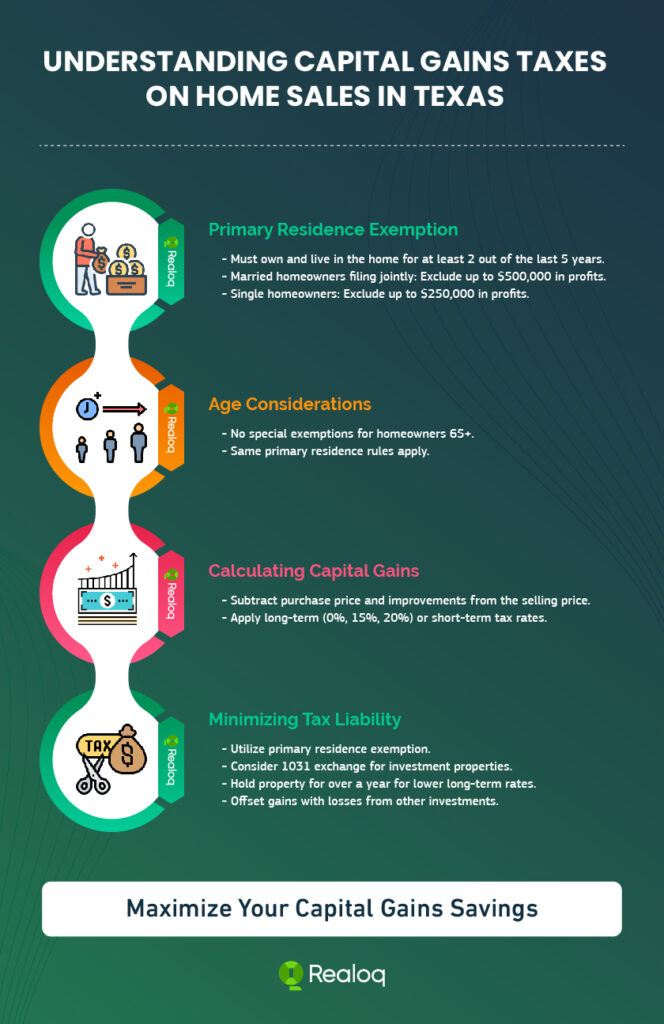

This comprehensive guide shall take you through some of the key issues regarding capital gains taxes on home sales in Texas such as primary residence exemption, age-related considerations, calculation methods and ways of minimizing your tax liability. With these ideas you can be able make informed decisions hence when selling your house save a great deal of money.

How Long Do You Have to Own a House in Texas to Avoid Capital Gains?

The number one aspect that will influence your liability for income taxes arising out of investment properties sold by individuals is how long they owned and resided in them before sale. The IRS has got the primary residence exemption which can be invaluable as it can help you avoid paying capital gain taxes on much of what you get in return for selling your property.

To qualify for the primary residence exemption, you must have owned and lived in the home as your primary residence for at least two out of the five years before the sale. This means that if you’ve owned and lived in your home for at least 24 months within the five-year period ending on the date of the sale, you may be eligible for the exemption.

For instance under these conditions Single homeowners could be permitted under this law up to $250,000 ($500,000 if married filing jointly) with respect to gain realized upon disposition or exchange made by them prior or after this 24 months period. This would mean that more of the sale price would go into the pockets of the seller.

Note however, that these two years do not have to be in a row. Even if one has lived in it for a total of 24 months within five years, he or she can still qualify for exemption. Furthermore, there are exceptions to the two-year rule like when one is forced to move because of his/her employment placements, health condition among other unforeseen events.

Do You Pay Capital Gains After Age 65?

Some homeowners often ask whether there could be age-related exemptions or special rules applicable on capital gains tax in home sales. There is no such thing as capital gains exemption triggered by old age only. At the age of sixty-five and above, homeowners are required to follow similar rules with regards to capital gains tax like other taxpayers

However, if older persons comply with the ownership and residency requisites mentioned above, they can still benefit from the prime residence exemption. Thus, when 65 or more years old, one is able to exclude up to $250,000 (Single) or $500,000 (Married filing jointly) of profit from capital gains tax provided you have owned and lived in your home for at least two out of the five years leading to its sale.

Note that there are also other tax considerations for seniors, including whether capital gains might increase one’s Social Security benefits taxation and Medicare premiums. If your income together with capital gains surpasses certain amounts then part of your social security may be taxable and you may end up paying high medicare premiums.

It is important that you talk to a qualified tax professional whose experience will lead to a personalized service based on your situations so as to minimize the negative effects which Capital Gain Tax may have on overall taxes.

How Do You Know How Much Capital Gains Tax to Pay?

Calculating what you owe in terms of capital gains on property sold can be difficult because it depends on multiple factors such as amount of income earned over a given period or any allowable deductions like expenses incurred towards making improvements on property.

To find out how much Capital Gain Tax you should pay, first calculate your gain. In this regard therefore; deduct the purchase price plus any improvements made from the selling price. The difference between these figures represents your capital gain.

After finding out your capital gain, determine the relevant tax rate depending on how long you held onto it as well as where it falls within those federal brackets. As per current regulations by IRS; long-term capital gains taxes are pegged at three rates i.e., 0%, 15% and 20%.

Based on the fact that this is for year 2024, here are some examples of what these rates would look like:

- 0% on individuals with adjusted taxable incomes of up to $41,675 (single) or $83,350 (married filing jointly)

- 15% for individuals with adjusted taxable incomes between $41,675 and $459,750 (single) or between $83,350 and $517,200 (married filing jointly)

- 20% on individuals with adjusted taxable incomes over $459.750 (single) or over $517.200 (married filing jointly).

These rates are applicable to long-term capital gains derived from assets held for more than one year. Short term capital gains tax which is obtained from assets held for less than one year is taxed as ordinary income.

However these tax brackets are subject to adjustments due to changes in legislation and inflation rates. Always consult a tax professional who can provide you with the most accurate guidelines from IRS based on your specific situation.

What Are the Rules of Capital Gains Tax?

Besides knowing about the capital gains tax rate, it’s important to also know about different regulations and requirements for capital gain taxation. It is these regulations that determine how much in taxes you pay and how you go about reducing your burden.

The main distinction among the rules governing Capital Gains Tax is made between short-term and long-term Capital Gains Taxation. The difference between short-term capital gains tax on properties held for less than a year and long terms ones that have been kept for more than twelve months should be taken into account in order to avoid being penalized by Internal Revenue Service if you made any mistake while declaring them.

Short-term capital gains are taxed at your ordinary income tax rate. This can be much higher than the long-term capital gains tax rates. For example, if you’re in the 22% income tax bracket and you have a short-term capital gain, you’ll pay 22% tax on that gain. However, if you have a long-term capital gain and your taxable income falls within the 15% capital gains tax bracket, you’ll only pay 15% tax on that gain.

Another important rule to know of is the primary residence exemption mentioned earlier. If you meet ownership and residency requirements, this exemption allows you to avoid paying a significant part of your profit as capital gains taxes.

When filing your federal taxes for reporting purposes, ensure that you utilize correct forms for this purpose like Schedule D or Form 8949 which give details about gains or losses on capital properties. You will need such information in case there are any home purchases done by anybody as well as sales thereof including any improvements done alongside them hence should be kept accurately.

By understanding these rules and requirements, homeowners can make informed decisions about selling their homes, how long they should hold onto their property and develop strategies to minimize their tax liability.

Shall I Pay Capital Gains Taxes When I Sell My House in Texas?

A common question among homeowners in Texas is whether they must pay a capital gains tax when selling a house. Yes! You are required to pay federal capital gains tax on the profit from the sale of your home unless it qualifies for primary residence exemption.

While there is no state-level capital gain tax in Texas, this does not exempt from being subject to federal level laws governing such taxes. The result is that where one has made a gain from his home sale and he did not meet above-explained conditions relating to another dwelling thus entitled to primary residence’s exception then he would necessitated reporting that purchase price under his/her national income tax return and paying the requisite amount thereof.

It should be noted that even if you are eligible for the primary residence exemption, you may still have to report the sale of your home on your tax return. However, you will not be required to pay taxes on that part of your proceeds which qualify for exclusion from your earnings, leading to a substantial reduction of your overall tax obligations.

How Do You Avoid Capital Gains Tax When Selling a House in Texas?

Although most homeowners have to pay capital gains tax when they sell their homes there are some ways in which you can avoid or lessen it while selling a house in Texas. Consequently, these strategies can help retain most profit and bring down the burden related with taxation.

The best way one can avoid paying this kind of fee is strictly adhering to stipulated conditions for primary residence exception. As has been explained above, if someone has lived in their home for at least 2 out of the previous 5 years before he/she sells it then such individual does not have to pay capital gain taxes on their profits unless they exceed $250,000 (single) or $500,000 (jointly filing married).

If you are selling an investment property as opposed to your primary residence, you might take advantage of 1031 exchange. The method permits a postponement of capital gains tax by investing the proceeds from the selling of your property into another similar one. Therefore it will be possible for you to avoid paying capital gains tax until you sell the replacement property in future.

Another way of reducing capital gains tax liability is by holding onto the property for more than one year before selling it. You can therefore pay long term capital gains rates which may be much lower than ordinary income tax rates applied on short term capital gains.

Also, there is potentiality that losses from other investments could offset one’s realized capital gains. Should investors have incurred a loss in some investments in the same tax year, such losses will offset your capital gain and decrease how much taxes you as well owe generally. It is essential not only to consult with a tax expert but also to make plans and keep appropriate records so as to adhere to the required rules.

FAQs

How long do you have to own a house in Texas to avoid capital gains?

At least two out of the five years before the sale is required for primary residence exemption.

Do you pay capital gains after age 65?

Yes, there is no specific age exemption, but the primary residence exemption still applies.

How do you know how much capital gains tax to pay?

Calculate the capital gain and apply appropriate federal tax rate based on income bracket.

What are the rules of capital gains tax?

Short-term gains are taxed at ordinary income rates, long-term gains at lower rates, and substantial part of profit could be wiped off by this kind of relief from taxation on an individual’s main family asset.

Do I have to pay capital gains tax when I sell my house in Texas?

Yes, one must expect to pay federal Capital Gains Tax unless he or she qualifies for a Primary Residence Exemption under which it is zero percent.

How to avoid capital gains tax when selling a house in Texas?

Use the primary residence exemption, perform a 1031 exchange in the case of investment properties, hold the property for one year or more and offset gains with losses.

Know Your Capital Gains Rules in Texas

Understanding Texas home sales’ Capital Gains Taxes constitute crucial aspects of house sale processes. Though Texas does not impose any state level Capital Gains Tax, homeowners are still subjected to federal Capital Gains Tax Regulations. Awareness of Primary Residence Exemption, Age Determination Considerations, Calculation Approaches and Methods and Strategies for Minimizing Your Taxable Income will help guide decision making process and possibly save substantial amount during disposal of homes.

It is important that all details about purchase date, improvements made or costs involved during sales be properly documented since they would play a vital role at later stages when determining ones taxable gain on sale in their federal return forms.It is also advisable that one talks with an experienced professional who knows everything about this type of taxation thus allowing him/her benefit from various exemptions that can help reduce his/her overall payment burden related to this imposed levy.

By understanding the rules and requirements surrounding capital gains taxes on home sales in Texas, you can approach the selling process with confidence and maximize your profits.