The Ultimate Guide to Buying

a Home in Texas | 2024

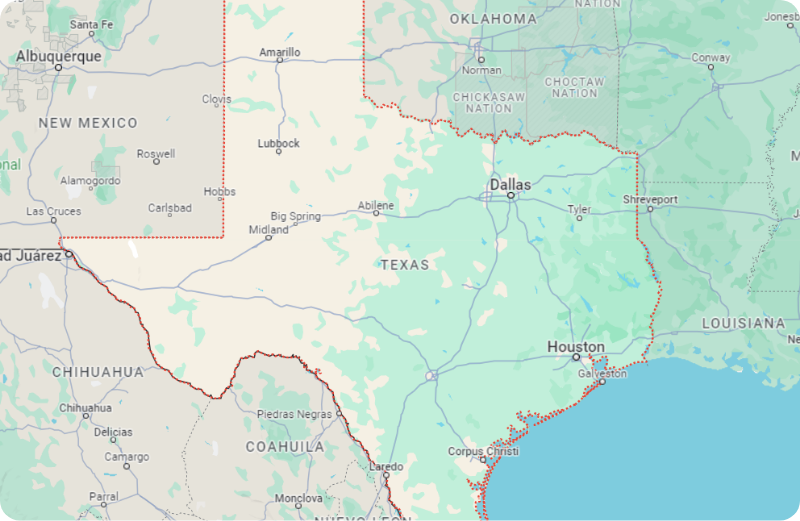

Understanding the Texas Real Estate Market

he Texas real estate market in 2024 will remain robust and continue to experience significant growth, driven by a combination of strong economic fundamentals, a steady population influx, and housing affordability that is still relatively favorable compared to many other major states across the country. As we move into the early part of 2024, the market is exhibiting solid demand across various geographic regions, accompanied by rising home prices and elevated sales activity.

The Texas economy has proven resilient, with diverse industries such as energy, technology, healthcare, and trade contributing to job creation and attracting new residents. This economic vitality has been a key factor underpinning the strength of the housing market. Despite the challenges posed by the pandemic in previous years, Texas has rebounded well, and its real estate sector has displayed remarkable resilience.

TABLE OF CONTENTS

- Pricing and Sales Data

- Regional Differences Within the State

- Impact of Economic Factors

- Texas First-Time Home Buyer Programs and Grants

- Financial Considerations

- Property Tax Regulations and Texas's Lack of State Income Tax

- Legal and Regulatory Factors

- Disclosure Requirements for Sellers

- Homeowners' Association (HOA) Laws and Regulations

- Environmental and Geographical Considerations

- The Importance of Environmental Assessments

- Market Entry Strategies

- The Role of Real Estate Agents

- FAQs on Buying a Home in Texas

- Work with a Realoq Agent

TABLE OF CONTENTS

- Pricing and Sales Data

- Regional Differences Within the State

- Impact of Economic Factors

- Texas First-Time Home Buyer Programs and Grants

- Financial Considerations

- Property Tax Regulations and Texas’s Lack of State Income Tax

- Legal and Regulatory Factors

- Disclosure Requirements for Sellers

- Homeowners’ Association (HOA) Laws and Regulations

- Environmental and Geographical Considerations

- The Importance of Environmental Assessments

- Market Entry Strategies

- The Role of Real Estate Agents

- FAQs on Buying a Home in Texas

- Work with a Realoq Agent

Pricing and Sales Data

In major metropolitan areas like Austin and Dallas, the price increases have been even more pronounced. Austin, known for its thriving tech scene and vibrant cultural atmosphere, has seen its median home price climb to around $435,915. Meanwhile, Dallas, with its robust economy and diverse job market, has a median home price of $390,000. These price points reflect the desirability of these cities and the fierce competition among buyers vying for limited inventory.

Sales data paints a picture of a healthy and active market, with transaction volumes remaining elevated despite the rising prices. The state’s economic opportunities, business-friendly environment, and alluring lifestyle continue to draw buyers from both within the state and from other parts of the country. The influx of new residents, coupled with the formation of new households, is fueling the demand for housing across various price points and property types.

However, the high demand and limited supply have created a competitive landscape for buyers. Inventory levels remain tight, with many homes receiving multiple offers and selling quickly. This has led to a seller’s market in many areas, where well-priced properties are snapped up above the asking price. Buyers need to be prepared to act decisively and have their financing secured in order to acquire their desired homes.

Regional Differences Within the State

Texas is a vast and diverse state, encompassing a wide range of real estate markets, each with its own unique characteristics and dynamics. Understanding these regional differences is essential for prospective buyers looking to navigate the Texas housing landscape.

Houston

Houston, the largest city in Texas and the fourth-largest in the United States, boasts a robust and diversified economy. Key industries like energy, healthcare, and aerospace are what drive the city’s economic strength. With its sprawling size and wide range of neighborhoods, Houston offers a diverse array of housing options to suit various preferences and budgets.

The median home price in Houston currently stands at around $325,990, making it relatively affordable compared to other major metropolitan areas in the country. The city’s real estate market benefits from its continuous job growth, particularly in the energy sector, which has historically been a significant driver of the local economy. However, it’s important to note that fluctuations in oil prices can impact housing demand and prices in Houston, as the city’s economy is closely tied to the energy industry.

Houston’s real estate market is characterized by a mix of property types, from high-rise condos in the vibrant downtown area to spacious single-family homes in the suburbs. The city’s extensive network of highways and public transportation options make it accessible from various parts of the metropolitan area. Additionally, Houston’s relatively low cost of living and absence of a state income tax make it an attractive destination for both first-time homebuyers and those looking to upgrade their living situations.

Dallas

Dallas, another major metropolitan area in Texas, is experiencing a thriving real estate market. Finance, technology, and telecommunications are just a few of the industries that drive the city’s economy. With a population of over 7 million in the Dallas-Fort Worth metroplex, the area offers a dynamic and fast-paced lifestyle, attracting professionals and families alike.

Dallas is known for its vibrant economy, excellent job opportunities, and high quality of life. The city’s robust job market, particularly in the technology and financial sectors, continues to attract new residents, fueling housing demand. Additionally, Dallas boasts a thriving arts and culture scene, world-class restaurants, and numerous recreational activities, making it an appealing place to call home.

Austin

Austin has been one of the hottest real estate markets in Texas over the past few years, and this trend shows no signs of slowing down. The city has gained a reputation as a technology hub, earning the nickname “Silicon Hills” due to the presence of numerous tech companies and startups. Austin’s vibrant cultural scene, excellent quality of life, and abundant outdoor recreational opportunities have also contributed to its popularity among homebuyers.

The median home price in Austin has reached approximately $435,915, making it one of the most expensive cities in Texas. The market is highly competitive, with limited inventory and strong demand driving up prices. They often find themselves in multiple offer situations, requiring quick action and competitive bids to secure their desired properties.

Austin’s real estate market offers a diverse range of housing options, from modern condos in the downtown area to spacious single-family homes in the surrounding hill country. The city’s unique blend of urban amenities and natural beauty appeals to a wide demographic, including young professionals, families, and retirees.

The technology sector is a major contributor to the city’s economy, with significant players like Apple, Google, and Facebook establishing operations nearby. This has led to substantial job growth and a highly educated workforce. Additionally, Austin’s renowned music scene, festivals, and outdoor activities contribute to its lively and eclectic atmosphere, making it an attractive destination for those seeking a high quality of life.

San Antonio

San Antonio offers a more affordable alternative to Austin and Dallas, with a median home price of about $300,000. As the second-largest city in Texas, San Antonio combines the amenities of a major metropolitan area with a more laid-back and historic charm.

The military, healthcare, and tourism are just a few of the sectors that support the city’s economy. San Antonio is home to several military bases, which contribute to the local economy and provide employment opportunities. The healthcare industry is also a significant driver, with renowned medical facilities and research institutions located in the city.

San Antonio’s real estate market is appealing to first-time homebuyers and those seeking more affordable housing options without sacrificing the conveniences of a large city. The city offers a variety of neighborhoods, from historic districts with charming bungalows to modern suburban communities with newer homes and amenities.

The city’s rich history and cultural heritage are evident in its architecture, festivals, and attractions. The famous River Walk, lined with restaurants, shops, and hotels, is a popular destination for both residents and tourists. San Antonio’s strong sense of community, excellent schools, and affordable cost of living make it an attractive option for families and individuals looking to put down roots in Texas.

Impact of Economic Factors

Economic factors play a significant role in shaping the Texas real estate market. Here are some key influences:

Oil and Energy Sectors

When oil prices are high, there tends to be increased demand for housing as the energy sector expands and creates jobs. The influx of workers and their families leads to a rise in home sales and rental activity, putting upward pressure on prices. This effect is particularly noticeable in cities like Houston, where the energy industry is a significant contributor to the local economy.

Conversely, when oil prices experience a downturn, it can lead to economic slowdowns in energy-dependent regions, affecting the real estate market. Job losses and reduced economic activity can dampen housing demand, leading to slower sales and potential price adjustments. However, the diversification of the Texas economy in recent years has helped mitigate the impact of oil price fluctuations on the overall real estate market.

Technology and Innovation

The technology industry has had a growing presence in Texas, particularly in Austin, which has earned the nickname “Silicon Hills” due to the concentration of tech companies and startups in the area. The influx of tech firms and professionals has had a significant impact on the real estate market, driving up demand for housing and contributing to rising prices.

The pandemic-accelerated rise of remote work has increased the allure of Texas cities for tech professionals. Many people are relocating to Texas due to the state’s affordability, business-friendly environment, and quality of life, which allow them to work from anywhere. This trend has contributed to the sustained demand for housing in the state’s major metropolitan areas.

Population Growth and Migration

Texas continues to experience significant population growth due to its strong economy, abundant job opportunities, and lower cost of living compared to other states. The state’s population has been increasing steadily over the past decade, with projections indicating continued growth in the coming years. This population influx is a major factor driving housing demand across the state.

Due to Texas’s affordability and lack of a state income tax, people from expensive states like Texas and New York are moving there more frequently. The lower cost of living, coupled with the availability of job opportunities, has made Texas an appealing destination for individuals and families looking to stretch their housing budgets further.

The migration trends have been particularly evident in cities like Austin, Dallas, and Houston, which have seen a steady influx of new residents from other states. These cities offer a combination of economic opportunities, cultural amenities, and a high quality of life, making them attractive to a wide range of demographics, from young professionals to retirees.

Population growth and migration patterns have a direct impact on the Texas real estate market. As more people move to the state, the demand for housing increases, putting upward pressure on prices and leading to a competitive market. The influx of new residents also spurs development, with builders and developers responding to the growing need for housing by constructing new homes and communities.

The rapid population growth also presents challenges, such as increased traffic congestion, strain on infrastructure, and potential affordability concerns. Cities and municipalities are working to address these issues through investments in transportation, infrastructure improvements, and initiatives to promote affordable housing options.

The Texas real estate market in 2024 will be a dynamic and thriving landscape, shaped by a confluence of economic, demographic, and regional factors. Understanding the intricacies of this market requires a comprehensive examination of current trends, regional variations, and the broader economic forces at play.

Texas’s diverse and resilient economy, characterized by strong growth in sectors such as energy, technology, healthcare, and trade, has been a key driver of the state’s housing market. The state’s business-friendly environment, coupled with its relatively affordable cost of living, continues to attract companies and individuals from across the country, fueling population growth and housing demand.

The major metropolitan areas of Houston, Dallas, Austin, and San Antonio each offer unique real estate opportunities, catering to a wide range of preferences and budgets. From the energy-driven economy of Houston to the tech-centric vibrancy of Austin, these cities showcase the diversity and strength of the Texas housing market.

Navigating the Texas real estate landscape also requires an understanding of the economic factors that influence the market. The state’s historical reliance on the oil and energy sectors is still significant, but technology and innovation are becoming more prevalent. Population growth and migration patterns, driven by the state’s affordability and economic opportunities, are also key factors shaping housing demand.

For prospective buyers, staying informed about market trends, regional differences, and economic drivers is essential for making informed decisions. Whether you are drawn to the urban excitement of Dallas, the cultural richness of Houston, the tech-driven energy of Austin, or the historic charm of San Antonio, Texas offers a wealth of possibilities in its real estate market.

As the state continues to grow and evolve, the Texas real estate market remains a compelling and dynamic arena, presenting both opportunities and challenges. By staying attuned to the latest developments and seeking the guidance of experienced professionals, buyers can successfully navigate this exciting and ever-changing landscape, finding the perfect home to suit their needs and aspirations in the Lone Star State.

Financial Considerations

When embarking on the journey of purchasing a home in Texas, it is essential to have a thorough understanding of the various mortgage options available to you. This comprehensive overview will provide you with detailed insights into the primary mortgage types, enabling you to make an informed decision that aligns with your financial goals and circumstances.

FHA Loans

Federal Housing Administration (FHA) loans have gained significant popularity among first-time homebuyers and individuals with lower credit scores. One of the key advantages of FHA loans is their lower down payment requirements, which typically start at a manageable 3.5% of the purchase price. This accessibility makes homeownership more attainable for a broader range of buyers who may not have substantial savings for a larger down payment.

Moreover, FHA loans offer more lenient credit requirements compared to other mortgage options. This flexibility allows individuals with less-than-perfect credit histories to still qualify for financing and realize their dream of homeownership. However, it is important to note that FHA loans require mortgage insurance premiums (MIP), which can add to your monthly payment obligations. These premiums serve as a form of protection for the lender, considering the lower down payment and credit requirements associated with FHA loans.

VA Loans

For those who have served our country, Veterans Affairs (VA) loans provide an exceptional opportunity to achieve homeownership. These loans are exclusively available to veterans, active-duty service members, and certain members of the National Guard and Reserves who meet the eligibility criteria set forth by the Department of Veterans Affairs.

VA loans come with a host of advantages that make them an attractive option for eligible borrowers. Perhaps the most significant benefit is the ability to purchase a home with no down payment requirement. This feature eliminates the need to save up a substantial amount of money upfront, making homeownership more accessible for those who have served in the military.

Another notable advantage of VA loans is the absence of private mortgage insurance (PMI). Unlike other loan types that require PMI when the down payment is less than 20%, VA loans do not impose this additional cost. This exemption can result in significant savings over the life of the loan, as PMI premiums can add up to a considerable amount.

Furthermore, VA loans often come with competitive interest rates, which can translate to lower monthly payments and long-term savings. The combination of no down payment, no PMI, and favorable interest rates makes VA loans an exceptionally advantageous option for eligible borrowers, substantially reducing the overall cost of homeownership.

USDA Loans

For those seeking to purchase a home in rural areas of Texas, the United States Department of Agriculture (USDA) offers an attractive financing option. Contrary to common misconceptions, several areas in Texas qualify as rural under USDA guidelines, making these loans accessible to a wider range of buyers than one might initially assume.

In addition to the no-down payment advantage, USDA loans also offer lower mortgage insurance costs compared to other loan types. This can result in more affordable monthly payments, making homeownership more manageable for those with limited financial resources. The reduced mortgage insurance costs, combined with the absence of a down payment requirement, make USDA loans an excellent option for buyers in eligible rural areas who are looking to maximize their purchasing power.

Conventional Loans

Conventional loans, which do not have the backing of government organizations like FHA, VA, or USDA loans, have their own distinct characteristics and requirements. Generally, conventional loans necessitate higher credit scores and larger down payments compared to their government-backed counterparts. However, this increased financial stability on the part of the borrower often translates to more flexibility in terms of property types and loan amounts.

For first-time homebuyers, conventional loans can be obtained with as little as 3% down, making them a viable option for those with limited savings. However, it is important to note that putting down less than 20% typically requires the payment of private mortgage insurance (PMI). PMI is an additional monthly cost that protects the lender in case of default, considering the higher risk associated with a smaller down payment.

To avoid the added expense of PMI, buyers can opt to put down at least 20% of the purchase price when obtaining a conventional loan. This larger down payment demonstrates a stronger financial commitment and reduces the lender’s risk, ultimately eliminating the need for PMI. While saving up a 20% down payment may take more time and effort, it can result in significant long-term savings by avoiding the ongoing cost of mortgage insurance.

Texas First-Time Home Buyer Programs and Grants

Recognizing the challenges faced by first-time homebuyers in the competitive Texas real estate market, the state offers several programs designed to provide assistance and make homeownership more attainable. These initiatives aim to bridge the gap between aspiring homeowners and the financial hurdles they may encounter.

My First Texas Home

The Texas Department of Housing and Community Affairs (TDHCA) has established the My First Texas Home program as a means to support first-time homebuyers and veterans in their pursuit of homeownership. This program offers 30-year fixed-rate mortgages, providing a stable and predictable monthly payment structure over the life of the loan.

One of the key benefits of the My First Texas Home program is the down payment and closing cost assistance it provides. Eligible participants can receive up to 5% of the loan amount to cover these upfront expenses, significantly reducing the financial burden associated with purchasing a home. This assistance can be instrumental in helping first-time buyers and veterans overcome the initial hurdle of saving up a sufficient down payment and closing costs.

Texas Mortgage Credit Certificate Program (MCC)

The Texas Mortgage Credit Certificate Program (MCC) is another valuable resource for first-time homebuyers in the state. This program allows eligible participants to receive a tax credit for a portion of the mortgage interest they pay each year. The MCC effectively reduces the amount of federal income taxes owed, making homeownership more affordable on an ongoing basis.

The credit amount is calculated based on the loan amount and can be as high as $2,000 per year. For many first-time homebuyers, this annual tax savings can provide a significant financial boost, freeing up funds that can be used for other homeownership expenses or personal financial goals. The MCC program is designed to make the dream of homeownership more attainable by reducing the overall cost of borrowing.

Home Sweet Texas Home Loan Program

The Home Sweet Texas Home Loan Program is specifically tailored to assist low and moderate-income Texans in achieving homeownership. This program offers a comprehensive package that includes a 30-year fixed-rate mortgage and down payment assistance of up to 5% of the loan amount.

By targeting individuals and families with limited financial resources, the Home Sweet Texas Home Loan Program aims to make homeownership more accessible to a broader range of Texans. The down payment assistance component is particularly valuable, as it helps bridge the gap between the required upfront costs and the borrower’s available savings. This support can be the key to unlocking the door to homeownership for many low and moderate-income households.

Homes for Texas Heroes Program

In recognition of the invaluable contributions made by certain professions to the state of Texas, the Homes for Texas Heroes Program offers specialized assistance to teachers, firefighters, EMS personnel, police officers, and veterans. This program acknowledges the dedication and sacrifices made by these individuals and aims to support their homeownership goals.

Eligible participants in the Homes for Texas Heroes Program can take advantage of a 30-year fixed-rate mortgage, providing a stable and predictable monthly payment structure. Additionally, the program offers down payment assistance of up to 5% of the loan amount, helping to alleviate the financial burden of upfront costs associated with purchasing a home.

By offering targeted support to these essential professionals, the Homes for Texas Heroes Program not only expresses gratitude for their service but also helps ensure that they have access to affordable and sustainable homeownership opportunities. This initiative recognizes the importance of enabling these heroes to establish roots in the communities they serve and protect.

Property Tax Regulations and Texas’s Lack of State Income Tax

Property Tax Regulations

When considering the financial aspects of homeownership in Texas, it is crucial to understand the state’s property tax regulations. Texas is known for having among the highest property tax rates in the nation, as the state relies heavily on these taxes to fund essential local services, including education, infrastructure maintenance, and public safety.

It is important for potential homebuyers to factor in these property tax obligations when budgeting for their monthly mortgage payments and overall housing expenses. While the high property taxes may initially seem daunting, it is essential to consider the broader context of Texas’s tax structure and the benefits it provides to residents.

Appraisal and Assessment

In Texas, properties are subject to annual appraisals conducted by county appraisal districts. These appraisals determine the market value of each property, which serves as the basis for calculating the property taxes owed. Homeowners receive an appraisal notice every year, outlining the assessed value of their property.

It is important to note that homeowners have the right to protest their appraisal if they believe their property has been overvalued. This process allows for a review and potential adjustment of the assessed value, which can impact the resulting property tax bill. Engaging in the appraisal protest process can be a valuable tool for homeowners to ensure fair and accurate property valuations.

Homestead Exemption

Texas offers a homestead exemption for primary residences, which can provide significant tax relief for homeowners. The general homestead exemption allows homeowners to exempt up to $40,000 of their home’s value from taxation. This means that if a home is valued at $300,000, the taxable value would be reduced to $260,000, resulting in lower property taxes owed.

In addition to the general homestead exemption, Texas offers additional exemptions for specific groups of homeowners. Seniors, disabled individuals, and veterans may qualify for further exemptions, which can substantially reduce their property tax burden. These exemptions recognize the unique financial challenges faced by these populations and aim to provide targeted relief.

Homeowners should familiarize themselves with the homestead exemption and any additional exemptions they may be eligible for. By taking advantage of these tax benefits, homeowners can potentially save thousands of dollars each year on their property taxes, making homeownership more affordable and manageable.

Impact of Texas’s Lack of State Income Tax

One of the most notable and attractive features of living in Texas is the absence of a state income tax. Unlike many other states that levy taxes on residents’ personal income, Texas allows its residents to keep more of their hard-earned money. This tax structure has significant implications for homeowners and the overall affordability of housing in the state.

For higher-income individuals, the lack of state income tax can result in substantial savings. By not having to pay a percentage of their income to the state government, residents have more disposable income available to allocate towards housing costs, including mortgage payments, property taxes, and home maintenance expenses. This increased financial flexibility can make homeownership more attainable and sustainable for many Texans.

However, it is important to recognize that the absence of a state income tax is partially offset by the higher property taxes in Texas. While residents may enjoy the benefit of keeping more of their income, they should be prepared to allocate a larger portion of their budget towards property taxes compared to states with lower property tax rates.

Despite this trade-off, the overall affordability of housing in Texas remains favorable when compared to states that have both high income taxes and elevated property prices. The combination of no state income tax and relatively reasonable housing costs, particularly in relation to income levels, makes Texas an attractive destination for homebuyers.

Moreover, the tax-friendly environment in Texas has a positive impact on economic growth and job creation. The absence of a state income tax attracts businesses and individuals to the state, as they seek to maximize their financial prospects and keep more of their earnings. This influx of economic activity and population growth contributes to a robust housing market and sustained demand for homes across various price points.

Navigating the financial landscape of homeownership in Texas requires a comprehensive understanding of the available mortgage options, state-specific first-time homebuyer programs, and the intricacies of property tax regulations. By thoroughly exploring the various financing avenues, such as FHA, VA, USDA, and conventional loans, prospective buyers can identify the most suitable option for their unique circumstances and financial goals.

Texas’s commitment to supporting first-time homebuyers is evident through initiatives like the My First Texas Home program, Texas Mortgage Credit Certificate Program, Home Sweet Texas Home Loan Program, and Homes for Texas Heroes Program. These programs offer valuable assistance in the form of down payment support, tax credits, and specialized financing options, making homeownership more accessible and affordable for a wider range of Texans.

While Texas’s higher property taxes may initially give pause to potential homebuyers, it is crucial to consider the broader context of the state’s tax structure. The absence of a state income tax can significantly boost residents’ disposable income, partially offsetting the impact of higher property taxes. Additionally, the availability of homestead exemptions and other tax relief measures can help mitigate the property tax burden for eligible homeowners.

Ultimately, the decision to purchase a home in Texas requires careful financial planning and a strategic approach. By staying informed about the various financial considerations, leveraging state-specific assistance programs, and proactively managing property tax obligations, homebuyers can successfully navigate the Texas real estate market and achieve their homeownership dreams.

The key to success lies in thorough research, seeking professional guidance when needed, and maintaining a long-term perspective on the financial benefits and responsibilities of homeownership. By taking a comprehensive and proactive approach to understanding the financial landscape of buying a home in Texas, aspiring homeowners can make informed decisions, maximize their resources, and build a solid foundation for their future in the Lone Star State.

Legal and Regulatory Factors

Homestead Laws

Texas boasts a robust set of homestead laws that provide significant benefits and protections to homeowners throughout the state. These laws are carefully designed to safeguard a homeowner’s primary residence from creditors and to offer certain tax advantages that can make homeownership more affordable and financially manageable.

The homestead laws in Texas recognize the fundamental importance of a person’s home and the need to ensure that it remains a secure and stable foundation for individuals and families. By offering legal protections and tax benefits, these laws aim to promote and preserve homeownership, which is widely regarded as a cornerstone of personal and community well-being.

Homestead Exemption for Property Taxes

One of the most significant advantages offered by Texas homestead laws is the homestead exemption for property taxes. This exemption allows homeowners to reduce the amount of property taxes they owe on their primary residence, providing much-needed relief from the high property tax rates that are common in many parts of the state.

Here’s a detailed look at how the homestead exemption works:

General Homestead Exemption

Under Texas law, homeowners are entitled to exempt up to $40,000 of the appraised value of their primary residence from taxation. This means that if your home is appraised at $300,000, you can subtract $40,000 from that value, resulting in a taxable value of $260,000. By reducing the taxable value of your home, the homestead exemption effectively lowers your annual property tax bill, allowing you to keep more money in your pocket.

Additional Exemptions

In addition to the general homestead exemption, certain groups of homeowners may qualify for additional exemptions that can further reduce their property tax burden. For example, seniors aged 65 and older and disabled individuals are eligible for an additional $10,000 exemption from school taxes. This extra exemption recognizes the unique financial challenges faced by these populations and aims to provide targeted relief to help them maintain their homes and quality of life.

It’s important for homeowners to understand and take advantage of the homestead exemption and any additional exemptions they may be eligible for. By doing so, they can potentially save thousands of dollars each year on their property taxes, making homeownership more affordable and sustainable in the long run.

To claim the homestead exemption, homeowners must file an application with their local appraisal district and provide proof of residency. Once granted, the exemption remains in place as long as the property remains the homeowner’s primary residence. It’s a simple process that can yield significant benefits, so all Texas homeowners should make sure to explore this opportunity.

Asset Protection

In addition to offering tax advantages, Texas homestead laws also provide strong protection against creditors. The homestead exemption is designed to shield a homeowner’s primary residence from being seized or forced into sale to satisfy most types of debts.

This asset protection feature is a critical safeguard for homeowners who may face financial hardships or unexpected liabilities. It guarantees that a person’s home will remain a safe haven that creditors cannot easily take away, even if they experience financial hardship or accumulate debt.

It’s important to note that there are some exceptions to this protection. Here are a few key scenarios where the homestead exemption may not apply:

Mortgage Liens

If you default on your mortgage payments, the lender who holds the lien on your property has the right to initiate foreclosure proceedings. The homestead exemption does not protect against foreclosure in the event of a mortgage default, as the lender’s lien takes priority over the exemption.

Property Taxes

Unpaid property taxes can also lead to serious consequences, including the placement of a tax lien on your home. If property taxes remain delinquent for an extended period, the taxing authority may choose to foreclose on the property to recover the outstanding debt. The homestead exemption does not offer protection against tax liens or foreclosures resulting from unpaid property taxes.

Home Improvement Loans

If you hire contractors to perform work on your home and fail to pay them for their services, they may be entitled to place a mechanic’s lien on your property. This type of lien gives the contractor a legal claim against your home to secure payment for the work performed. The homestead exemption does not prevent the placement of mechanic’s liens or the potential foreclosure that can result from non-payment.

Despite these exceptions, it’s crucial to keep in mind that the homestead exemption still applies to the vast majority of unsecured debts, such as credit card balances, medical bills, and personal loans. This means that creditors cannot force the sale of your home to satisfy these types of debts, providing a valuable layer of security for homeowners.

It is crucial for all homeowners to comprehend the extent and restrictions of the asset protection Texas homestead laws provide. By being aware of these protections and the exceptions that apply, homeowners can make informed decisions about their finances and take steps to safeguard their most important asset—their home.

Disclosure Requirements for Sellers

When selling a property in Texas, sellers are subject to specific disclosure requirements that are designed to inform potential buyers about the condition of the property. These requirements play a crucial role in promoting transparency and protecting buyers from unexpected issues that could arise after the purchase.

Seller’s Disclosure Notice

The primary disclosure document in Texas is known as the Seller’s Disclosure Notice. Sellers must complete this extensive form and give it to prospective buyers, which includes a list of any known problems or flaws with the property. The Seller’s Disclosure Notice covers a wide range of topics, ensuring that buyers have a clear understanding of the property’s condition before making an offer.

Here’s a closer look at the key aspects covered in the Seller’s Disclosure Notice:

Property Condition

Sellers are required to disclose any known defects or issues with the property, including plumbing problems, roof leaks, foundation issues, or pest infestations. This information helps buyers assess the overall condition of the home and identify potential repair or maintenance needs.

Environmental Hazards

Sellers must disclose the presence of any environmental hazards, such as asbestos, lead-based paint, radon, or other hazardous materials. This information is critical for buyers to understand any health risks associated with the property and to plan for any necessary remediation or mitigation measures.

Structural Components

The Seller’s Disclosure Notice requires detailed information about the condition of the home’s major systems, including the heating, ventilation, and air conditioning (HVAC) system, electrical system, plumbing system, and structural components. This disclosure helps buyers evaluate the functionality and potential lifespan of these critical systems.

Water Damage

Sellers must disclose any past or present water damage, including flooding history. Water damage can lead to serious issues like mold growth and structural deterioration, so buyers need to be aware of any such incidents to make an informed decision about the property.

Homeowners’ Association

If a homeowners’ association (HOA) is in charge of the property, the sellers must give information about the HOA, including fees, assessments, and any relevant rules. Understanding the HOA’s role and financial obligations is essential for buyers considering properties in planned communities or condominiums.

It’s important to note that the Seller’s Disclosure Notice is not a warranty or guarantee of the property’s condition. Sellers are only required to disclose issues that they are aware of, and they may not have knowledge of every potential problem. However, if a seller intentionally withholds or misrepresents information on the disclosure form, they could face legal consequences.

Buyers should carefully review the Seller’s Disclosure Notice and use it as a starting point for further due diligence. It is advisable to hire a qualified home inspector to perform a thorough evaluation of the property’s condition and find any problems that the seller might not have disclosed.

Additional Disclosures

In addition to the Seller’s Disclosure Notice, there may be other specific disclosures required depending on the property and its location. Here are a couple of notable examples:

Lead-Based Paint Disclosure

For homes built before 1978, federal law mandates that sellers disclose the presence of lead-based paint and provide buyers with an informational pamphlet about the risks associated with lead exposure. This disclosure helps buyers make informed decisions and take necessary precautions to protect their health and safety.

Natural Hazard Disclosures

If the property is located in an area prone to natural hazards, such as a floodplain, near a coastal area, or in a seismically active region, sellers must disclose this information to potential buyers. These disclosures help buyers understand the potential risks and insurance requirements associated with the property.

Remember, while disclosures offer valuable insights, they should not be relied upon as the sole source of information about a property. Buyers should always conduct their own investigations, hire professional inspectors, and thoroughly research the property and its surroundings before finalizing a purchase.

Homeowners’ Association (HOA) Laws and Regulations

In Texas, homeowners’ associations (HOAs) are in charge of many planned communities and condominiums. These organizations play a significant role in maintaining the appearance, value, and overall quality of life within the community. Understanding the laws and regulations surrounding HOAs is crucial for buyers considering properties in these types of developments.

HOA Fees and Assessments

One of the primary functions of an HOA is to collect fees or assessments from homeowners to cover the costs of maintaining common areas, amenities, and community services. These fees can vary significantly from one community to another, depending on factors such as the size of the development, the amenities offered, and the level of services provided.

Before purchasing a property in an HOA-governed community, it’s essential to carefully review the association’s financial statements and understand the fee structure. Here are a few key points to consider:

Monthly or Annual Fees

HOAs typically charge homeowners a monthly or annual fee to cover ongoing expenses like landscaping, pool maintenance, and general upkeep of common areas. The HOA board typically develops a budget for these fees, which is subject to change over time.

Special Assessments

In addition to regular fees, HOAs may occasionally levy special assessments to fund major repairs, improvements, or unexpected expenses. These assessments can be significant and are often required to be paid in a lump sum or over a short period of time.

Reserves

Well-managed HOAs maintain a reserve fund to cover the cost of long-term maintenance and capital improvements. Buyers should review the HOA’s reserve study and ensure that the association has adequate funds set aside to handle future expenses without the need for excessive special assessments.

Delinquencies

It’s important to investigate the HOA’s delinquency rate, which reflects the percentage of homeowners who are behind on their fees. A high delinquency rate can indicate financial instability within the association and may lead to reduced services or increased fees for the remaining homeowners.

By thoroughly evaluating the HOA’s financial health and understanding the fee structure, buyers can make informed decisions about the long-term costs and obligations associated with living in a particular community.

Covenants, Conditions, and Restrictions (CC&Rs)

In addition to financial considerations, HOAs also enforce a set of rules and regulations known as covenants, conditions, and restrictions (CC&Rs). These guidelines govern various aspects of property ownership and community life, ensuring a consistent appearance and maintaining property values within the development.

Here are some common areas addressed by CC&Rs:

Architectural Controls

Many HOAs have strict guidelines regarding exterior modifications to properties, such as paint colors, landscaping, and additions. Homeowners are typically required to obtain approval from the HOA’s architectural review committee before making any significant changes to their property’s exterior.

Usage Restrictions

CC&Rs often include rules about how properties can be used, such as prohibiting short-term rentals (like Airbnb), limiting the number and types of pets allowed, or restricting parking of certain vehicles (e.g., RVs or boats) on the property.

Maintenance Obligations

Homeowners are usually responsible for maintaining the appearance of their property in accordance with the HOA’s standards. This may include requirements for regular lawn care, exterior painting, and general upkeep of the property’s appearance.

It’s crucial for buyers to carefully review the CC&Rs before purchasing a property in an HOA-governed community. These rules can have a significant impact on how homeowners can use and enjoy their property, so it’s important to ensure that the restrictions align with your lifestyle and preferences.

Compliance and Enforcement

HOAs have the legal authority to enforce CC&Rs and other community rules, and they can take action against homeowners who fail to comply. Non-compliance can result in various consequences, depending on the severity of the violation and the specific provisions of the HOA’s governing documents.

Common enforcement measures include:

Fines

HOAs may levy fines against homeowners for violations of CC&Rs or other rules. These fines can accumulate over time if the violation is not corrected, and the HOA may have the authority to place a lien on the property to secure payment.

Legal Action

In extreme cases, HOAs may pursue legal action against a homeowner to enforce compliance or to recover unpaid fines and assessments. This can include filing a lawsuit or initiating foreclosure proceedings against the property.

Loss of Privileges

Some HOAs may revoke a homeowner’s access to community amenities, such as pools or fitness centers, until the violation is corrected or fines are paid.

To avoid potential conflicts with the HOA, homeowners should familiarize themselves with the CC&Rs and make a good faith effort to comply with the rules. If a violation occurs, it’s generally best to work proactively with the HOA to resolve the issue and avoid escalation.

Dispute Resolution

Despite the best efforts, disputes between homeowners and HOAs can sometimes arise. Many HOAs have established procedures for resolving these conflicts, which may include mediation, arbitration, or other alternative dispute resolution methods.

Here are a few key points to keep in mind regarding dispute resolution:

Review Governing Documents

The HOA’s bylaws and other governing documents should outline the specific procedures for resolving disputes. Homeowners should familiarize themselves with these provisions and follow the prescribed steps when a conflict arises.

Communicate Openly

If a dispute occurs, homeowners should attempt to communicate openly and respectfully with the HOA board or management company. Many issues can be resolved through dialogue and good faith efforts to find a mutually agreeable solution.

Seek Legal Counsel

In some cases, it may be necessary to seek legal advice or representation to protect your rights as a homeowner. An attorney experienced in HOA law can provide guidance on your options and help you navigate the dispute resolution process.

By understanding the HOA’s dispute resolution procedures and maintaining open lines of communication, homeowners can often resolve conflicts in a constructive manner and maintain a positive relationship with the association.

Navigating the legal and regulatory landscape of buying a home in Texas requires a solid understanding of key factors such as homestead laws, seller disclosure requirements, and HOA regulations. Each of these elements plays a crucial role in shaping the rights, responsibilities, and overall experience of homeownership in the state.

Texas homestead laws offer significant benefits to homeowners, providing both tax advantages and strong protections against creditors. By claiming the homestead exemption and understanding the asset protection provisions, homeowners can safeguard their primary residence and enjoy valuable financial relief.

Seller disclosure requirements ensure transparency in real estate transactions, empowering buyers with critical information about a property’s condition and potential issues. By carefully reviewing the Seller’s Disclosure Notice and any additional required disclosures, buyers can make informed decisions and avoid unexpected surprises down the road.

For those considering properties in planned communities or condominiums, understanding HOA laws and regulations is essential. From evaluating fees and assessments to reviewing CC&Rs and dispute resolution procedures, buyers must take a comprehensive approach to assess the implications of living in an HOA-governed community.

Ultimately, staying informed about these legal and regulatory factors is key to successfully navigating the Texas real estate market. By working with experienced professionals, such as real estate agents and attorneys, buyers can ensure that they are making sound decisions and protecting their interests throughout the home-buying process.

Remember, while the legal and regulatory landscape may seem complex at times, the rewards of homeownership in Texas are well worth the effort. With its vibrant economy, diverse communities, and strong legal protections for homeowners, the Lone Star State offers a wealth of opportunities for those ready to embark on the journey of owning a home.

As you explore the Texas real estate market, take the time to educate yourself on these critical legal considerations. By doing so, you’ll be well-equipped to make informed choices, protect your investment, and create a solid foundation for your future as a homeowner in this dynamic and thriving state.

Environmental and Geographical Considerations

Texas, with its expansive and diverse geography, is a state that encompasses a wide range of landscapes and climates. From the sandy beaches of the Gulf Coast to the rolling hills of the Hill Country and the vast plains of the Panhandle, each region of Texas has its own unique characteristics and charm.

This geographical diversity also means that different parts of the state are susceptible to various types of natural disasters, including hurricanes, tornadoes, and floods. When considering the purchase of property in Texas, it is crucial for prospective buyers to have a thorough understanding of the potential risks associated with these natural hazards and how they can impact the value, safety, and long-term viability of their investment.

Hurricanes

Risk Factors and Locations

One of the most significant natural disaster risks in Texas is the threat of hurricanes, particularly along the Gulf Coast region. Cities such as Houston, Galveston, and Corpus Christi are especially vulnerable to these powerful tropical cyclones that originate in the Gulf of Mexico.

Hurricanes can bring a devastating combination of intense winds, heavy rainfall, and storm surges, causing extensive damage to homes, businesses, and infrastructure. The destructive force of hurricanes can lead to flooding, structural damage, and prolonged power outages, disrupting the lives of residents and impacting the overall economy of the affected areas.

When considering purchasing property in hurricane-prone regions of Texas, it is essential to assess the specific risk factors associated with the location. Properties closer to the coastline or in low-lying areas are generally at a higher risk of experiencing the most severe impacts of hurricanes. Factors such as elevation, proximity to bodies of water, and the strength of local infrastructure can all influence the vulnerability of a property to hurricane damage. It is advisable to research the hurricane history of the area, including the frequency and intensity of past storms, to gain a better understanding of the potential risks.

Insurance Implications

Given the significant risks posed by hurricanes, insurance is a critical consideration for property owners in affected areas. Standard homeowners insurance policies frequently cover hurricane-related wind damage, but they might not cover flood damage from storm surges. It is important to carefully review the terms and conditions of your insurance policy to ensure you have adequate coverage for the specific risks associated with your property’s location.

In many hurricane-prone areas, separate flood insurance is often required to protect against the financial losses caused by storm surge flooding. The National Flood Insurance Program (NFIP), administered by the Federal Emergency Management Agency (FEMA), offers flood insurance to homeowners in participating communities. It is crucial to determine whether your property is located in a designated flood zone and to obtain the necessary flood insurance coverage to safeguard your investment.

In addition to flood insurance, some coastal areas of Texas may require separate windstorm insurance, especially in high-risk zones designated by the Texas Windstorm Insurance Association (TWIA). This specialized insurance provides coverage for wind and hail damage associated with hurricanes and other severe storms. Homeowners should consult with their insurance agents to determine the specific requirements and options available in their area.

Building Codes

To mitigate the potential damage caused by hurricanes, Texas has implemented stringent building codes and regulations in hurricane-prone areas. These codes are designed to ensure that structures are built to withstand the intense winds and storm surges associated with these powerful storms. Compliance with these building codes is essential for the safety and long-term resilience of properties in hurricane-prone regions.

One key aspect of hurricane-resistant construction is the use of wind-resistant materials and techniques. This includes the installation of hurricane straps, which help to securely anchor the roof to the walls of the house, reducing the risk of roof loss during high winds. Impact-resistant windows and reinforced doors are also commonly required to protect against flying debris and prevent wind and water intrusion.

In flood-prone areas, building codes often mandate that homes be elevated above the base flood elevation (BFE) to minimize the risk of flood damage. This involves constructing the living spaces of the home above a certain height, as determined by FEMA’s flood maps, to ensure the structure remains above the expected flood levels during a hurricane or severe storm.

Roofing standards in hurricane-prone areas are also more stringent, with requirements for materials and installation methods that can withstand high winds and prevent roof loss. The use of hurricane clips, properly sealed roof decking, and wind-resistant shingles are common elements of hurricane-resistant roofing systems.

By adhering to these building codes and incorporating hurricane-resistant features into the construction or renovation of a property, homeowners can significantly enhance the safety and resilience of their investment. It is important to work with experienced contractors and building professionals who are well-versed in the specific requirements and best practices for hurricane-resistant construction in Texas.

Tornadoes

Risk Factors and Locations

In addition to hurricanes, Texas is also prone to tornadoes, which can occur throughout the state but are most common in the northern regions, including the Dallas-Fort Worth area and the Panhandle. Tornadoes are violent, rotating columns of air that extend from thunderstorms to the ground, often causing severe damage to structures and posing a significant risk to life and property.

Tornadoes can develop quickly and with little warning, making it crucial for property owners to be prepared and have a plan in place to seek shelter when necessary. The risk of tornadoes is highest during the spring and summer months, when atmospheric conditions are most conducive to their formation.

When assessing the tornado risk for a particular property, it is important to consider factors such as the location’s proximity to known tornado alleys, the frequency and severity of past tornado events in the area, and the availability of adequate shelter or safe rooms.

Insurance Implications

Homeowners insurance is a critical consideration for properties in tornado-prone areas of Texas. Most standard homeowners insurance policies provide coverage for damage caused by tornadoes, including both wind damage and damage from hail that often accompanies these storms. However, it is important to review your policy carefully to ensure that you have sufficient coverage limits to fully protect your investment.

When determining the appropriate level of coverage, consider factors such as the replacement cost of your home, the value of your personal belongings, and any additional structures on your property. It may also be advisable to consider additional endorsements or riders to your policy to provide enhanced protection for specific risks or valuable items.

Deductibles for wind and hail damage may be higher in areas with a higher risk of tornadoes, so it is important to factor this into your budgeting and financial planning. Working closely with your insurance agent can help you navigate the options available and select the coverage that best meets your needs and budget.

Building Codes

While building codes for tornado resistance are not as extensively developed as those for hurricanes, there are still measures that can be taken to enhance the safety and resilience of properties in tornado-prone areas.

One important consideration is the installation of a tornado safe room or storm shelter. These reinforced structures are designed to provide a high level of protection against the extreme winds and flying debris associated with tornadoes. Safe rooms can be incorporated into the design of a new home or retrofitted into an existing structure, and they should meet the standards set forth by FEMA and the International Code Council (ICC).

In addition to safe rooms, building with reinforced materials and techniques can help to enhance the overall resilience of a property against high winds. This may include the use of impact-resistant windows and doors, the installation of stronger roof-to-wall connections, and the use of anchor bolts to secure the structure to the foundation.

When purchasing or building a property in a tornado-prone area, it is advisable to consult with experienced contractors and engineers who can provide guidance on the most effective strategies for tornado mitigation and ensure that the structure meets or exceeds the relevant building codes and standards.

Floods

Risk Factors and Locations

Flooding is a pervasive risk throughout Texas, affecting properties located along rivers, in coastal regions, and in urban areas with inadequate drainage systems. The central region of the state, known as “Flash Flood Alley,” is particularly susceptible to sudden and severe flooding events due to its unique topography and proximity to multiple river systems.

Flooding can cause extensive damage to homes and property, leading to costly repairs and potential health hazards associated with mold growth and contaminated water. In addition to the immediate impacts of flooding, properties in flood-prone areas may also face long-term challenges such as reduced market value and difficulty obtaining insurance coverage.

When evaluating the flood risk for a specific property, it is essential to review the Federal Emergency Management Agency’s (FEMA) flood maps, which designate flood zones based on the level of risk. Properties located in high-risk zones, such as Special Flood Hazard Areas (SFHAs), are required to have flood insurance if they have a mortgage from a federally regulated or insured lender.

In addition to FEMA’s flood maps, it is also important to consider local factors that may influence the flood risk, such as the property’s proximity to rivers, streams, or other bodies of water, the presence of nearby levees or dams, and the capacity of local drainage systems to handle heavy rainfall events.

Insurance Implications

Flood damage is typically not covered by standard homeowners insurance policies, making it critical for property owners in flood-prone areas to obtain separate flood insurance coverage. The National Flood Insurance Program (NFIP), administered by FEMA, is the primary provider of flood insurance in the United States.

To determine if a property requires flood insurance, prospective buyers should consult FEMA’s Flood Map Service Center, which provides detailed information on the flood risk for specific addresses. If the property is located in a designated flood zone, lenders will typically require the purchase of flood insurance as a condition of the mortgage.

Flood insurance policies through the NFIP provide coverage for both the structure of the home and its contents, up to certain limits. Homeowners in high-risk areas may also have the option to purchase additional coverage through private insurers to supplement the NFIP policy.

It is important to note that flood insurance policies generally have a 30-day waiting period before coverage takes effect, so it is crucial to obtain insurance well in advance of any potential flooding events. Additionally, flood insurance premiums can vary significantly based on the level of risk and the specific characteristics of the property, so it is advisable to obtain quotes from multiple providers to find the most appropriate coverage at a reasonable cost.

Building Codes

To mitigate the risks associated with flooding, Texas has adopted building codes and regulations that govern the construction of homes and other structures in flood-prone areas. These codes are designed to ensure that buildings are elevated above the expected flood levels and constructed with materials and techniques that can withstand the impacts of floodwater.

One of the primary requirements for properties in flood-prone areas is to build the living spaces of the home above the base flood elevation (BFE), as determined by FEMA’s flood maps. This typically involves constructing the home on stilts, piers, or other elevated foundations that allow floodwater to pass beneath the structure without causing significant damage.

In addition to elevation requirements, building codes may also specify the use of flood-resistant materials in the construction of homes in flood-prone areas. These materials, such as concrete, brick, and pressure-treated wood, are designed to withstand prolonged exposure to water without deteriorating or losing structural integrity.

Proper site grading and drainage systems are also critical components of flood-resistant construction. By ensuring that the property is graded to direct water away from the foundation and that adequate drainage systems are in place to handle heavy rainfall events, homeowners can reduce the risk of water intrusion and minimize the potential for flood damage.

When purchasing or building a property in a flood-prone area, it is essential to work with experienced contractors and engineers who are familiar with the specific building codes and regulations that apply to the location. Compliance with these codes not only enhances the safety and resilience of the property but may also be required for obtaining flood insurance coverage and securing financing.

The Importance of Environmental Assessments

When purchasing property in Texas, conducting thorough environmental assessments is a crucial step in the due diligence process. These assessments help to identify potential environmental hazards or contamination that could have significant impacts on the value, safety, and habitability of the property. By identifying these issues early in the buying process, prospective purchasers can make informed decisions and take appropriate measures to mitigate any associated risks.

Phase I Environmental Site Assessment (ESA)

The first step in the environmental assessment process is typically a Phase I Environmental Site Assessment (ESA). This preliminary investigation is designed to identify any potential or existing environmental contamination liabilities associated with the property. The Phase I ESA is a non-invasive study that involves a thorough review of the property’s history, a site inspection, and a search of relevant government databases.

One of the key components of a Phase I ESA is the historical use review. This involves researching the past uses of the property and the surrounding areas to identify any activities that may have contributed to environmental contamination. This could include former industrial operations, gas stations, dry cleaners, or other businesses that commonly use hazardous materials.

In addition to the historical use review, a Phase I ESA also includes a site inspection, during which an environmental professional visually assesses the property for any signs of contamination or environmental concerns. This may involve looking for evidence of chemical storage, stained soils, distressed vegetation, or other indicators of potential contamination.

The Phase I ESA also includes a review of relevant federal, state, and local regulatory databases to determine if the property or any nearby sites have been identified as having environmental issues or violations. This could include listings on the Environmental Protection Agency’s (EPA) National Priorities List (NPL), which identifies sites with known or threatened releases of hazardous substances, or state databases that track leaking underground storage tanks or other environmental incidents.

Based on the findings of the Phase I ESA, the environmental professional will provide a report that outlines any potential environmental concerns and recommends further action, if necessary. This report can be used by prospective buyers to assess the environmental risks associated with the property and make informed decisions about how to proceed with the transaction.

Phase II Environmental Site Assessment

If the Phase I ESA identifies potential environmental concerns that warrant further investigation, a Phase II Environmental Site Assessment may be recommended. The Phase II ESA is a more detailed and invasive study that involves the collection and analysis of soil, water, and other samples from the property to determine the presence and extent of any contamination.

During a Phase II ESA, environmental professionals will use specialized equipment to collect Samples from areas of the property that have been identified as potentially contaminated. These samples are then sent to a laboratory for detailed analysis to determine the specific contaminants present and their concentrations.

Based on the results of the sample analysis, the environmental professional will prepare a report that outlines the extent and nature of any contamination found on the property. This report will also include recommendations for further action, such as additional testing, remediation, or monitoring, depending on the severity and type of contamination identified.

The findings of a Phase II ESA can have significant implications for the value and marketability of a property. If contamination is found, the cost of remediation can be substantial, and the presence of environmental hazards may deter potential buyers or impact the property’s appraised value. In some cases, the contamination may be deemed too severe or costly to remediate, rendering the property unusable or unsellable.

By conducting a Phase II ESA when necessary, prospective buyers can gain a more comprehensive understanding of the environmental risks associated with a property and make informed decisions about how to proceed. This may involve negotiating with the seller to address any identified contamination, adjusting the purchase price to account for the cost of remediation, or choosing to walk away from the transaction altogether.

Impact of Local Environmental Factors on Property Values

In addition to the specific environmental hazards that may be identified through the assessment process, there are also broader environmental factors that can have a significant impact on property values in Texas. These factors, which are often related to the overall quality of the local environment and the presence of nearby sources of pollution or contamination, can influence the desirability and marketability of properties in a given area.

Air Quality

One important environmental factor that can affect property values is air quality. In areas with high levels of air pollution, whether due to industrial activities, heavy traffic, or other sources, property values may be negatively impacted. Poor air quality can lead to health concerns for residents, reducing the overall desirability of living in the affected area.

Cities such as Houston and Dallas have historically struggled with air quality issues, largely due to the presence of large industrial facilities and busy transportation corridors. Properties located in close proximity to these sources of pollution may experience lower values and slower appreciation compared to those in areas with cleaner air.

Prospective buyers should research the air quality in the areas where they are considering purchasing property, using resources such as the EPA’s Air Quality Index (AQI) and local air monitoring data. This information can help inform decisions about where to purchase property and may also be used to negotiate with sellers or to advocate for measures to improve air quality in the area.

Water Quality

Another critical environmental factor that can impact property values is water quality. Access to clean, safe drinking water is essential for public health and is a key consideration for many homebuyers. In areas with known water quality issues, such as contamination from industrial activities, agricultural runoff, or aging infrastructure, property values may be adversely affected.

In Texas, water quality concerns have arisen in various parts of the state, often related to the presence of heavy industry, mining operations, or intensive agricultural practices. For example, in some rural areas, the use of fertilizers and pesticides has led to elevated levels of nitrates and other contaminants in groundwater, while in urban areas, aging water infrastructure has contributed to issues with lead and other pollutants.

Prospective buyers should research the water quality in the areas where they are considering purchasing property, using resources such as the Texas Commission on Environmental Quality’s (TCEQ) Drinking Water Watch database and local water utility reports. If water quality issues are identified, buyers should consider the potential costs of water treatment or remediation and factor these into their decision-making process.

Soil Stability

Soil stability is another important environmental factor that can affect property values in Texas. In areas with expansive clay soils, which are common in many parts of the state, buildings and infrastructure can be subject to significant damage due to soil movement and shifting. This can lead to foundation problems, cracked walls, and other structural issues that can be costly to repair and can negatively impact property values.

In addition to expansive soils, properties located in areas prone to erosion or landslides may also face challenges related to soil stability. These issues can be particularly acute in regions with steep slopes, such as the Texas Hill Country, or in coastal areas where erosion due to storm surge and rising sea levels is a growing concern.

Prospective buyers should research the soil conditions in the areas where they are considering purchasing property, using resources such as soil maps and geotechnical reports. If soil stability issues are identified, buyers should consider the potential costs of mitigation measures, such as foundation repairs or retaining walls, and factor these into their decision-making process.

Noise Pollution

Noise pollution is another environmental factor that can have a significant impact on property values in Texas. Properties located in close proximity to major highways, airports, or industrial facilities may experience elevated levels of noise, which can reduce the overall quality of life for residents and make the properties less desirable to potential buyers.

In urban areas, traffic noise is a common source of noise pollution, particularly for properties located near busy roads or intersections. In addition to the impact on quality of life, exposure to constant traffic noise has been linked to various health issues, including sleep disturbance, stress, and cardiovascular disease.

Similarly, properties located near airports or in flight paths may experience significant noise pollution from aircraft operations. This can be a particular concern for properties located near major airports, such as Dallas/Fort Worth International Airport or George Bush Intercontinental Airport in Houston.

Industrial facilities, such as factories, refineries, or power plants, can also be sources of significant noise pollution, particularly for properties located in close proximity to these sites. In addition to the noise itself, these facilities may also generate other forms of pollution, such as air or water contamination, which can further impact property values.

Prospective buyers should research the potential sources of noise pollution in the areas where they are considering purchasing property, using resources such as noise maps and local zoning information. If significant noise pollution is identified, buyers should consider the impact on quality of life and resale value and factor this into their decision-making process.

Environmental and geographical considerations play a crucial role in the process of buying property in Texas. From the risks associated with natural disasters like hurricanes, tornadoes, and floods to the potential impacts of local environmental factors such as air and water quality, soil stability, and noise pollution, there are a wide range of issues that prospective buyers must take into account when evaluating potential properties.

By conducting thorough due diligence, including environmental assessments and research into local environmental conditions, buyers can gain a more comprehensive understanding of the risks and challenges associated with a particular property or area. This information can be used to make informed decisions about where to purchase property, how to mitigate potential hazards, and how to protect the value and safety of the investment over time.

In addition to the direct impacts on individual properties, environmental and geographical factors can also have broader implications for the Texas real estate market as a whole. For example, the increasing frequency and severity of natural disasters associated with climate change may lead to shifts in population and development patterns, as well as changes in insurance and lending practices.

Similarly, the ongoing challenges associated with air and water quality, soil stability, and other environmental issues may lead to increased regulatory scrutiny and potential liability for property owners, as well as greater public awareness and demand for environmentally sustainable development practices.

As the Texas real estate market continues to evolve, it will be increasingly important for buyers, sellers, and other stakeholders to stay informed about the latest developments related to environmental and geographical considerations. By working with experienced professionals, such as environmental consultants, real estate agents, and attorneys, and by staying up-to-date on relevant laws, regulations, and best practices, buyers can navigate the complexities of these issues and make sound decisions that protect their investments and contribute to the long-term sustainability and resilience of the Texas real estate market.

Ultimately, while the challenges associated with environmental and geographical factors in Texas real estate can be significant, they are not insurmountable. By taking a proactive, informed approach to these issues and by prioritizing sustainability, safety, and resilience in their decision-making processes, buyers can find opportunities to invest in properties that meet their needs and contribute to the overall health and vitality of the communities in which they are located. With careful planning and due diligence, the Texas real estate market can continue to thrive, even in the face of the complex and ever-evolving challenges posed by the state’s unique environmental and geographical landscape.

Market Entry Strategies

The Texas housing market is known for its fierce competition, particularly in major metropolitan areas such as Austin, Dallas, and Houston. Buyers who are looking to enter this dynamic market must be well-prepared and employ strategic approaches to increase their chances of success. Navigating the complexities of the Texas housing market requires a combination of market knowledge, financial readiness, and the ability to make swift, informed decisions.

Making Competitive Offers

Before embarking on the journey of making an offer on a property, it is essential to have a solid grasp of the local market dynamics. This understanding forms the foundation upon which buyers can make informed decisions and craft competitive offers that align with the current market conditions.

To gain this crucial market knowledge, buyers should dedicate time to researching recent sales in their desired area. This research should focus on key metrics such as average sale prices, the pace at which homes are selling, and any discernible trends in price changes over time. By analyzing this data, buyers can develop a clearer picture of the demand, supply, and overall competitiveness of the market.

Get Pre-Approved for a Mortgage

In a highly competitive market like Texas, having a mortgage pre-approval is not just recommended; it is a necessity. A mortgage pre-approval is a formal letter from a lender that states the amount of money a buyer is qualified to borrow based on their financial situation, including income, assets, and credit score.

Obtaining a pre-approval letter demonstrates to sellers that a buyer is serious, committed, and financially capable of purchasing their property. It serves as a powerful tool in the negotiation process, as it instills confidence in the seller that the buyer has the means to follow through with the transaction.