Your credit score plays a significant role in determining whether or not you will qualify for a home loan and the loan terms you may be offered. As you prepare for one of the most important financial transactions in your life – buying a home – it’s essential to understand what credit scores are, what goes into them, how they are used in the mortgage approval process, and most importantly, how to improve them over time.

Credit scores have become integral to our financial lives. These three-digit numbers carry tremendous weight when it comes to accessing credit and loans. This is especially true when seeking a mortgage to finance what will likely be the largest purchase in your lifetime – your home. Credit scores give lenders a snapshot of your financial responsibility and patterns.

The higher your scores, the more likely lenders view you as a lower risk for defaulting on a loan. This results in increased chances of approval and better loan terms. Understanding what goes into your credit score empowers you to take positive actions that can enhance your mortgage candidacy.

We will explore the key factors that shape credit scores, why they matter so much in mortgage lending decisions, and constructive ways for you to build and sustain strong credit. As you educate and equip yourself in the realm of credit scoring, partnering with knowledgeable real estate and lending professionals will further support your journey toward homeownership.

Understanding Credit Scores

At its most basic, a credit score is a three-digit number calculated from the information in your credit report, a detailed record of your payment activities as a borrower and credit card user. This numeric representation communicates your creditworthiness. Credit scores are generated by applying statistical models and formulas to your credit history data to determine the likelihood that you will pay back borrowed money as agreed.

The two primary scoring systems used by lenders today are the FICO® Score and VantageScore®. While similar, they have some differences in their scoring methodologies. FICO® Scores range from 300 to 850. VantageScores also span 300 to 850. For both models, higher scores signal lower credit risk whereas lower numbers indicate a higher risk of default.

Many lenders use FICO® Scores to help guide their lending decisions across mortgages, credit cards, and other lines of credit. According to myFICO, 90% of lending decisions rely on FICO® Scores. These scores remain the most widely recognized credit risk indicators.

VantageScore® has been increasingly adopted among lenders because the model incorporates rent, telephone, and utility payment data to determine creditworthiness. An advantage of VantageScore® is its ability to score individuals with very little traditional credit history.

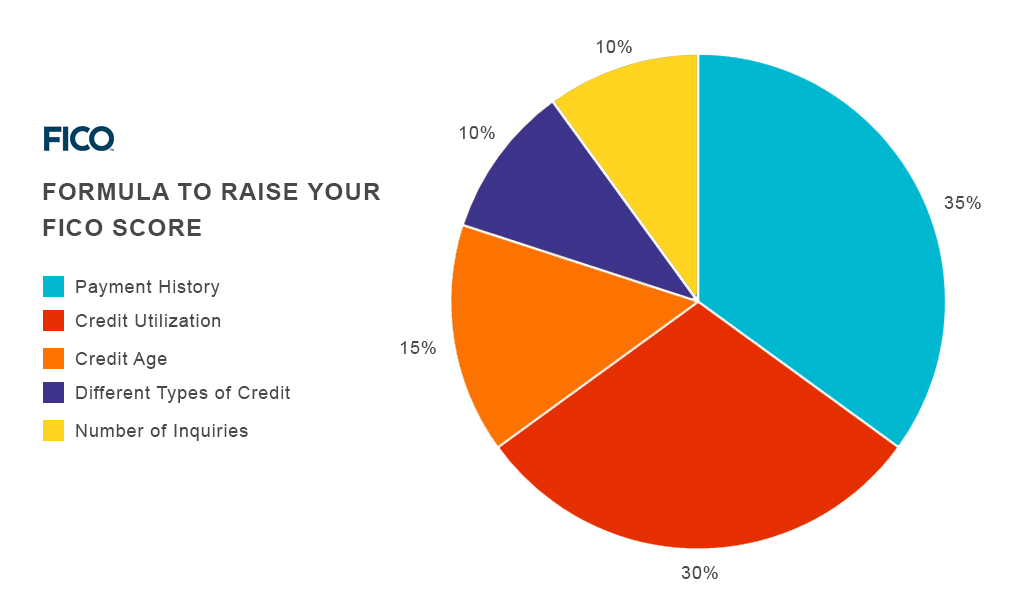

The ingredients that determine your credit scores are summarized in five main categories tracked by the credit bureaus – Experian, TransUnion, and Equifax. These factors provide insight into your past and present credit behaviors. By understanding their influence, you can make strategic financial decisions to cultivate strong credit health over time. The categories are:

Payment History

Your payment history holds the most weight in calculating credit scores, accounting for 35% of a FICO® Score. This factor examines your track record of paying back credit cards, retail accounts, installment loans, mortgage, and other lines of credit. Timely payments signal positive credit management whereas late payments, bankruptcies, and other defaults damage scores.

Strategic Steps: Avoid late payments whenever possible. If faced with financial hardship, speak with lenders before missing payments to understand options.

Credit Utilization

The level of credit you use compared to available limits is called credit utilization. This aspect holds 30% influence in FICO® Scores. Owing large amounts relative to total credit access equates higher risk and lower scores. Experts recommend keeping utilization below 30%.

Strategic Steps: Ask issuers for higher limits and maintain low balances compared to limits. Consider making extra payments before statement closing dates.

Credit History Length

At 15% weighting in FICO® Scores, the length of your credit experience is also key. A proven track record with both recently opened and older, actively used accounts helps raise scores.

Strategic Steps: Cultivate a healthy mix of newer credit alongside longstanding accounts. Let lengths of positive history build.

Credit Mix

Credit mix represents 10% of the FICO® Score formula. It refers to having different types of credit – revolving (credit cards) and installment (auto, student, mortgage loans) from a blend of issuers. Varied credit experiences suggest ability to responsibly manage diverse accounts.

Strategic Steps: Open credit cards and purposefully take out installment loans with predictable payments. Manage them all reliably.

New Credit

When you open new accounts, hard credit inquiries result and the average age of your credit history decreases – both penalize scores in the short term. However, judicious new credit decisions can strengthen scores over time. This factor has 10% influence on FICO® Scores.

Strategic Steps: Be selective in applying for additional credit only when needed and ready. Let applications spacing out over time.

Credit Scores and Mortgages

While credit scores influence lending decisions across all industries, they carry greater weight when seeking a home loan. Mortgage lenders view credit scores as pivotal in determining the likelihood of on-time mortgage payments over decades. Many rely primarily on FICO® Scores when assessing loan qualification and terms.

According to the 2022 Home Mortgage Disclosure Act data, over 80% of approved conventional mortgages were given to those with credit scores above 660.

This emphasizes the central importance lenders place on credit scores in mitigating their lending risks. They further analyze scores in relationship to requested loan amounts and your total debts when making mortgage decisions.

The minimum FICO® Scores for mortgage approval generally fall in these ranges:

- Score above 620: More options for conventional financing

- Score of 580-619: Strong chance for FHA-insured financing

- Score below 580: Difficult to secure financing approval

While these provide baseline thresholds, aiming for scores over 700 improves your prospects for preferable interest rates saving tens of thousands over a mortgage. Maximizing your score in partnership with lenders optimizes outcomes.

Credit Score Updates

The major credit bureaus receive updated data about your payment activities and credit balances on a continual basis. However, they do not recalculate your scores after every payment or purchase. Instead, the bureaus refresh their credit data snapshots monthly.

These routine updates mean you won’t see immediate score changes from each financial move. But your actions do accumulate value over time. For example, paying down balances steadily monthly raises your score as growing available credit and lowered utilization emerge in bureau reports.

Major credit events also trigger more immediate score updates. Examples include paying off an installment loan, filing bankruptcy, or missing several payments in succession. These meaningful shifts in your credit patterns merit faster recalculation to provide lenders the latest picture of your creditworthiness when you apply for new financing.

The Major Credit Bureaus

The three primary nationwide credit bureaus that lenders consult when assessing financial risk are Experian, TransUnion, and Equifax.

These private companies are also referred to as Consumer Reporting Agencies under the Fair Credit Reporting Act. Their role is to collect, organize, update, store and provide your credit data when requested by authorized parties such as lenders or employers.

You actually have potentially dozens of credit reports that each bureau independently updates and maintains regarding your borrowing behaviors. This means you have multiple FICO® Scores and VantageScores® across the bureaus depending on their distinct recordkeeping.

When you authorize your credit to be checked such as during a new credit card or mortgage application, you provide permission for credit bureaus to release requested details from your report. Reports can vary slightly across the bureaus since they don’t all receive identical details on every account. These differences underscore why checking all of your scores is advisable.

Strategies for Improving Credit Scores

The beauty of credit scores lies in their fluid, customizable nature. With purposeful strategy and discipline, people can cultivate improved scores over time by adopting positive financial habits. While quick fixes may prove elusive without careful planning, incorporating targeted tactics into your long-term financial behaviors will compound gains.

Here are 5 impactful strategies for boosting credit scores:

- Pay bills on time every month – Set reminders to pay at least the minimums ahead of due dates on all accounts to benefit payment history.

- Lower credit utilization – Pay down balances to reduce owed amounts closer to 30% or less of available credit limits.

- Live below your means – Design a realistic budget that allows you to pay bills fully while spending consciously on needs first, then wants if affordable.

- Hold longstanding credit accounts – Let positive payment histories on active accounts lengthen over many years to signal reliability.

- Limit new credit – Judiciously apply for new financing only when appropriate for your situation to minimize score dings.

Other helpful tips include:

- Requesting higher credit limits to lower utilization

- Calling lenders to negotiate fixes to reporting errors on your history

- Signing up for credit monitoring to receive alerts on report changes

- Consolidating balances to term loans with predictable payments

The key is consistency applying these credit profile enhancers over many years. With concerted energy toward positive financial patterns, your improved scores will reflect reduced lending risk.

Using Credit Monitoring Tools

In our data driven world, purposefully monitoring your credit should be essential in every consumer’s financial toolkit. With online access to credit reports and scores easier than ever via user-friendly dashboards and mobile apps, staying abreast of your evolving credit health is pivotal.

Watching for discrepancies, errors or suspicious activity allows you to address issues before major damage. Tracking also reminds when key actions are needed such as payments coming due. Monitoring further lets you gauge real-time score progress in response to credit management tactics.

Many free or freemium credit tracking options exist today including CreditKarma, Experian, Credit Sesame and others. For advanced features like unlimited reports from all bureaus, identity theft protection and custom advice, paid subscriptions services prove worthwhile for serious credit monitoring. Research sites fitting your budget and needs.

Seeking Professional Credit Advice

With credit reports containing many intricacies and scoring formulas featuring much complexity, partnering with credit counseling experts simplifies improvement journeys. These specialists help decipher bureau documents line by line to identify areas needing corrections. They further educate on how different financial behaviors influence specific credit score factors.

Non-profit agencies like Money Management International offer free or affordable services based on your situation. They can provide customized guidance for managing debts and optimizing credit mixes. For those recovering from bankruptcies or consumer proposals, counselors guide prudent steps to rebuild scores. Whether looking for a quick tune-up or long-term renovation of your credit health, advice from a caring professional can prove invaluable.

Frequently Asked Questions About Credit Scores

What is a good credit score for buying a house?

For the most favorable mortgage rates and loan options, aim for credit scores over 740. Conventional financing remains readily available for scores between 620-739. Government-backed FHA loans allow scores starting around 500 with added protections for lenders.

How often do credit scores update, and what triggers an update?

The three major credit bureaus refresh your credit data monthly, but may only recalculate scores quarterly unless meaningful shifts occur in your borrowing behaviors that merit faster updates to keep lenders well informed.

What are the differences between the major credit bureaus?

While Experian, TransUnion and Equifax all collect extensive details on consumer payment activities and credit accounts, they may receive and record updated information at slightly different times. Checking reports from all three ensures complete accuracy.

Can paying off debts quickly improve my credit score?

Making larger or full balance pay downs reduces owed amounts closer to credit limits which directly improves credit utilization ratios that influence around 30% of scores. Just be sure to still make minimum payments on all other debts while aggressively paying any accounts down.

How long does it take to see improvements in my credit scores?

Score updates based on credit management changes may gradually register over three to six months as positive patterns emerge. But your long-term consistency applying responsible habits matters most over many years.

Steps to Improve Your Credit Score

- Step 1: Check your latest credit reports and scores from all three bureaus. Identify discrepancies or risks.

- Step 2: Make a plan to correct errors, lower balances below 30% of limits, and enable on-time payments.

- Step 3: Sign-up for credit monitoring to track real-time progress as new payment behaviors take effect.

- Step 4: Consider meeting with credit counseling agencies to analyze current reports with expert guidance on improvement strategies.

- Step 5: Remain focused on financially responsible patterns – paying bills on time, limiting debts, monitoring diligently.

- Step 6: In 12-18 months, recheck reports and scores to validate measured improvements from disciplined credit management.

- Step 7: As homeownership draws nearer, consult lenders on boosting scores even higher before mortgage pre-approval.